February was a rocking month, but was that it for the spring season? And what’s going on with the Realtor Commissions lawsuit and settlement (see bottom)? Here’s the stats for San Diego real estate from the 1st quarter of 2024, along with predictions for the rest of the year. Always hand-written with stats direct from our local MLS.

2024 Q1 Summary

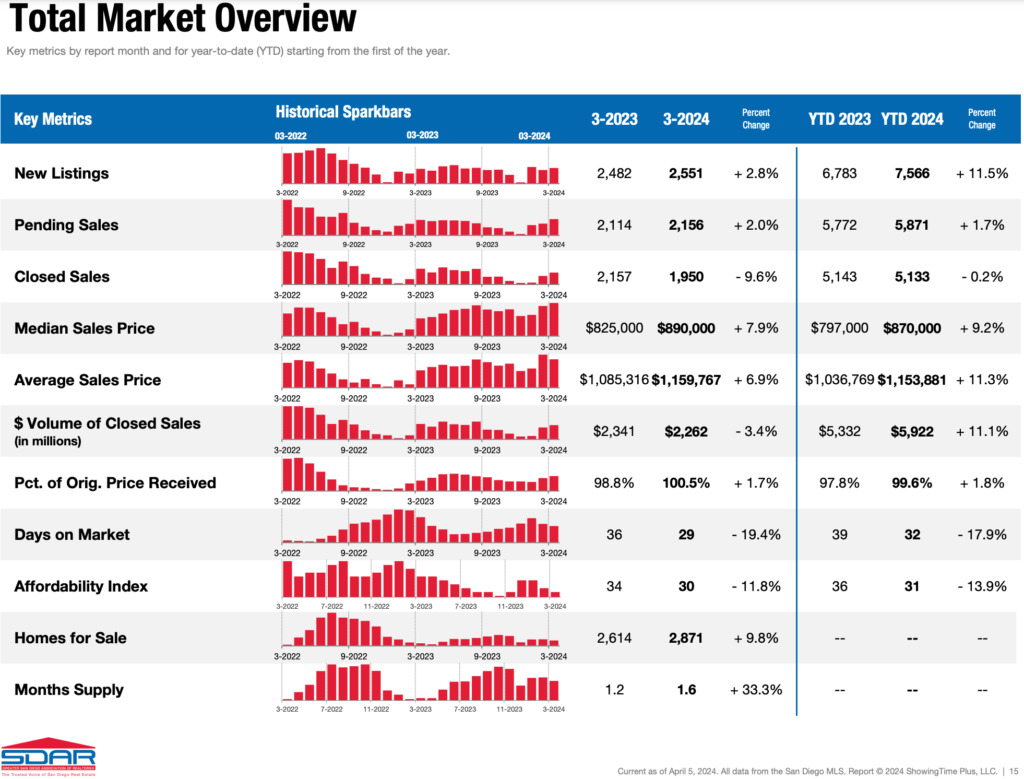

Sales Volume Level: Q1 2024 had 1.4% MORE closed sales than Q1 2023.

Inventory Increasing: Up 6.6% from end of Q4 2023. Up 9.8% from a year ago.

Loan Rates UP: Started 2024 at 6.72%. Ended Q1 2024 at 7.05%

Home Values Up: Median price went from $835k to $890k in Q1. Up 7.9% from Q1 2023

Govt./Policy Changes: Fed Fund Rate stayed level the 1st quarter

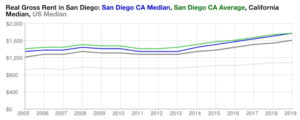

Rental Rates Down: Median Rents Up ~ 1% in Q1 to end down 2.5% rom Q1 2023

The Above image is a visual summary of my statistics reference from our local San Diego Association of Realtors.

Click here to View Full Stats from San Diego Association of Realtors

2024 Q1 – Was that it for the Spring Season?

Sales Volume:

Sales Volume has been dropping for over 2 years now. We went from 39,762 in 2021, to 21,746 in 2023. That’s a 45% drop in sales in just 2 years and we are not having a high sales year thus far in 2024. The obvious reasons for a drop in sales demand are higher home loan rates + higher prices. Our affordability index just tied it’s lowest point that I’ve seen, but because there is so little supply of inventory and the economy (and inflation) keeps growing, prices have continued to edge up. It’s unlikely that sales numbers will come back without a notable change in the market affordability, such as a drop in loan rates or prices.

Inventory:

Inventory has been low for years with minor and seasonal variations. Thus far we are mimicking 2023 for detached inventory, but attached inventory is up over 30% over the same time last year. Overall, once inventory edged up in January from end of year lows, we have stayed mostly level ever since.

New Detached listings were up about 10% in Q1 of 2024 compared to Q1 of 2023, whereas new Attached listings were up about 20% from last year. The large majority of people selling have been estates (dead people), divorcees as well as random relocations, investors and now, Realtors. Most “regular” people with a job/life that own their home are staying put. Anyone living in their home likely has an amazing home loan rate around 3%, so why would they sell their home and buy another if they will have to pay more than twice their current rate for the new home, which in most cases is barely better than what they have?

Loan Rates:

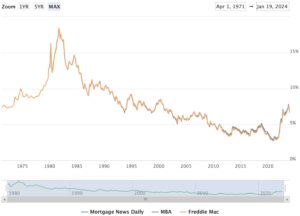

Home loan rates rose steadily most of 2023 and peaked in mid-October at just over 8% before they dropped pretty quickly towards the end of the year. The 30-year fixed MND rate average started 2024 at 6.72% and has been rising steadily ever since. After the most recent fed meeting & inflation news, rates jumped again and are currently sitting at 7.43% on 4/17/24.

Will rates come down later this year? Most pundits have been expecting rates to improve in 2024 but not until the 3rd or 4th quarter of the year. At this point, I think that any Fed rate drops will be pushed back once again. Loan rates have been going up all year, instead of going down. So instead of people talking about rates getting under 6% again, they are now talking about them in the mid 6’s by the end of the year, which means to me….high 6’s…..

Home loan rate charts:

Long Term Rate Chart: 1971 – 2024 Short Term Rate Chart: 2023

Govt / Policy Changes:

Raising the Federal Funds rate continues to be the Fed’s main weapon against inflation. Inflation has dropped considerably in 2023, along with the biggest and quickest rate hike in history, but it’s not quite to the point where the Fed is satisfied. They had previously signalled that they expected to drop the Federal Funds rate 3x by the end of 2024, but in Jerome Powell’s most recent speech, he made it clear that it was going to take longer than expected before they can bring rates down again.

Home Values:

Home Values were on the upswing most of 2023. Prices peaked in August 2023 with a new median home value high for detached homes of $1,015,000. Home values also didn’t drop as quickly towards year end, so we ended the year up 10.7% start to finish. In Q1 2024, we started out slow in early January, but then the market roared for about 30-45 days and median values went up about 6% in a really short time. Most of this jump was seen in detached homes vs attached condos – detached homes went from $942k to $1.05m which is an 11.4% increase in 90 days.

Rental Prices:

As some of you know, I’ve been building a property management business in the last few years. I am currently managing 7 units and seeking more. Please think of me the next time you or someone you know wants to rent their home/condo.

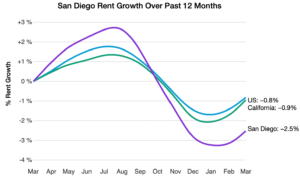

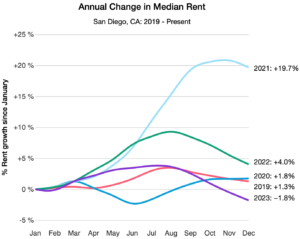

While rental rates had been on the rise along with home values, 2023 saw it’s first yearly decline in median rents for over 10 years. Because rental rates are going opposite of home values & loan rates, it’s likely more people will continue to rent than would otherwise buy this year. If enough people turns towards renting rather than buying, then this will put upward pressure on rental prices once again.

Monthly median rents ended Q1 down 2.5% year over year. Rents have risen about 1% in Q1 which is a typical seasonal trend.

Median Rents – Last 12 months Median Rents SD: 2019-Present Median Rents: 2005-2019

What does the future hold? My theories & predictions are below…

Of course, these are just predictions….that said, I think that our market is heading for major turbulence. Half of this turbulence will come from a change in laws governing the industry (read below). The rest will be from low affordability that pushes sellers and buyers into a mexican standoff. Rates continue to bring affordability down to unseen before levels. We are currently tied for the record lowest affordability set last year Aug-Oct. Many pundits keep predicting rates will drop, but inflation keeps coming in hotter than expected and so does the economy. This means the fed will push off those 3 rate decreases they told everyone they were going to do this year. I expect 1 rate drop from the Fed this year, no more. I expect average rates to remain over 7% until late 3rd or even 4th quarter. If they drop sooner, it will likely be precipitated by “bad” economic news/data.

I’m not expecting much, if any, equity increases the rest of the year, unless rates drop. I’m expecting low sales numbers, too. Prices are currently flat due to the most recent rate jumps and perhaps it’s a natural pull back from the huge jumps realized in the detached market in Q1. I believe the economy/jobs will remain relatively strong which will give us just enough demand to keep home prices from falling much further. Once rates start to drop a little at the year’s end, we may see one last flurry of activity to finish off 2024.

There are definitely a number of would be buyers renting on the sidelines and their decision to buy or keep renting is financial and rate dependent. As such, any big move in the home loan rate market is going to have a major effect on the sales market.

Rents slid down quite a bit at the end of 2023 to end the year down. While a dip is normal to end the year, it’s also seasonally normal for rents to go up in Q1 and Q2. Thus far, we have gone up about 1% in Q1. Since the sales market has recently slowed in the last 30 days, that is likely to put more buyers into the renting pool and raising demand. Thus, I am expecting rental rates to keep going up for the next 3-6 months. While home loan rates remain high and the economy strong, rental values will hold or go up. As such, I predict we will end the year up 1-3% gaining back much of what we lost in 2023.

UPDATE 5/7/24: 2 weeks since writing this, average loan rates have dropped from 7.51% to 7.19%. I’m told this is due to Janet Yellin’s announcement that the Fed is going to start repurchasing Bonds again. So I’m a bit more optimistic about the sales market than I was when I wrote this a couple weeks ago

What’s Going on with the Realtor Commissions Lawsuit / Settlement?

Ok, forget the headlines you read….there are some horrible articles and opinion pieces out there, so let’s start with the facts. There are 2 rule changes:

-

- A seller / seller’s agent may NOT Advertise a buyer broker commission they are offering on MLS.

- Buyer Agents must have a signed Buyer Broker agreement before ANY showings

Let’s break these down…grab a cup of coffee.

Rule 1: A seller / seller’s agent may NOT Advertise a buyer broker commission they are offering on MLS.

For the last 10 years it was typical to offer 2.5% to a buyer broker (90% of deals happened this way). Sometimes 3% or even 4% was offered to really incentive more agents to obtain more showings and a higher price. And, sometimes a “discounted” commission was offered at 2.25%, 2.0% or on very very rare occasion, lower. You could offer 1% or nothing, the choice has always been up to the Seller, but the MLS had a field noting how much they are offering a buyer agent upfront, as a marketing fee, to promote the listing to their buyer.

The seller pays the listing agent a total commission. Part of that commission is to market/sell the property and represent the seller’s best interests. The other half/portion, the seller agent offers to a buyers agent for finding/bringing the successful buyer. Sellers offer this marketing fee so that buyers do not have to pay their agent out of pocket as they rarely have the money for a down payment, closing costs and an additional 2-3%. How it was set up made home buying more accessible to more people – a larger pool brings a seller a higher price. In the near future, home buying will lean towards those who already have money and exclude more of the next generation of first-time buyers. I foresee home ownership going down because of this new law.

Moving forward, the buyer broker compensation field will be removed and we cannot specifically mention a buyer broker compensation on MLS, however the seller can still offer a buyer broker compensation to get more buyers in to see their property. So how will this be communicated? There will be a “Concessions” field where you can list a percentage or amount that you are willing to offer a buyer for “whatever closing costs they incur” which can include paying their buyer agent. I think most agents will use this field to show their seller’s intent. But it’s highly likely that buyer agents will have to call each seller agent first, and get something in writing perhaps, before showing.

On the flip side, there are sellers that may not offer to pay a buyer agent at all. I literally saw a listing this morning that offered 0 compensation to buyer brokers at list price and a 1% commission if the buyer paid $10k more, which happens to be 1.1%, so I’m not sure if they did their math right….or did they, lol. This seller, and others that follow his lead, is what I call “penny-wise and pound foolish”. They will “save 1-2%” in fees and sell their home for 2-3% less because they will cut their buyer pool in half AND because people (including appraisers btw) will expect to pay less for a Discounted listing. How many buyers have the extra cash to pay their agent out of pocket? Lenders are already scrambling to try and cover the buyer’s agent fee in their loans. I suspect someone will figure out how to finance it as we always have been. In the meantime, agents like this may end up double-ending deals more often – if buyers don’t want to pay a buyer agent to give them proper representation, then they will go straight to the listing agent more often than they did in the past. Dual agency has always been a small single-digit percentage of the market, but it’s going to grow a lot, maybe 3-5x, in the next 6 months.

Do you know what else is going to grow in the next year? Lawsuits! The only real winner IMO from this lawsuit and settlement is the real estate attorneys who will be fielding all the lawsuits that will happen until, and if, we eventually find some new norms.

Rule 2: Buyer Agents must have a signed Buyer Broker agreement before ANY showings

The second rule is actually one I’m all for. Buyer agents need to have an agreement with their buyers before looking at homes. No more looky-loos….great!! And there will also be less bad/inexperienced agents because they have to show their experience upfront and fight for their value/commission now. Within this agreement will be a timeframe that the buyer and agent are committed to each other, a list of services/expectations AND an agreed upon commission (can be 0) that the buyer will pay their agent if the seller does not. I suspect that if a seller doesn’t offer a commission, buyers will simply request it within their offers and pay more to net the seller the same money. As long as their offer nets the seller the most money, sellers will be fine paying a buyer agent commission, whatever it is.

So what will the new norm be? I don’t know! And frankly, it can’t be any worse than the last year has been, so let’s get on with it. Some people think we will start modeling the European real estate market more. It’s likely the buyer agent commission norm will be closer to 2% in the near future, and I’m already seeing it trending to that. I’m pretty sure we will also see a lot of sellers trying to offer 1% or nothing in the short-term. But what will happen to buyer & seller agent commissions when it becomes a buyers market? As always, commissions are market driven and they will rise and fall with the market. We’ll see a bunch of “discount” or flat-fee buyer brokers like we did in the mid-late 2000’s (and then they may all go out of business again). Remember Assist-2-sell and Help-u-sell and IpayOne??? Gone. Commissions have never been set….they’ve always been negotiable. That said, going lower than 2% will not be sustainable enough to offer good service, so if enough consumers insist on paying Realtors as a whole less, they will get less. Less experienced agents (i’ll be gone) with Less time for each client and it will result in…..you guessed it….Less money on their sale (and more time/headache/lawsuits). I predict that this experiment to net consumers more money by insinuating they should pay Realtors less will amount in a complete wash and a complete waste of time. But what do I know? The future has a way of proving us wrong so I am preparing myself for, and open to, multiple scenarios.

Want a free lunch?

Send me a referral that buys/sells/rents and I will buy you lunch every month for the next year in person to say thank you!

I have always appreciated your referrals – they have been the foundation of my business.

Adam Pascu

Broker / Owner

73 Degrees Realty

858-761-1707

ps. feel free to check out my San Diego Green Homes site if you have a passion for living green/sustainably and contact me (cell: 858-761-1707) for a free consult regarding how to green your home.